katerafferty

Year-End Checklist of Estate Planning Documents for New Jersey Residents

Three crucial legal estate planning documents to update before year-end to avoid New Jersey probate and Inheritance tax issues.

NJ Real Estate Fraud: Protect Your Investment

Real estate fraud is a growing threat in New Jersey, including deceptive property schemes and dangerous wire fraud targeting homebuyers. This post breaks down common tactics—loan origination fraud, phishing attacks, and foreclosure scams—and explains how state laws like the Consumer Fraud Act offer powerful protection.

Avoid Court Battles: NJ Guardianship & Digital Assets

New Jersey is changing its guardianship laws and tackling digital assets, including electronic wills and online accounts. Preparing your estate plan now to include these digital assets is critical, especially with legislation like Senate Bill S421 on the table, ensuring you keep control over your digital future.

Haunted Houses and Real Estate: What You Need to Know About New Jersey’s Paranormal Disclosure Laws

New Jersey is one of the few states with specific laws regarding the disclosure of paranormal activity in real estate transactions. This means that sellers in New Jersey are only obligated to disclose paranormal activity if the buyer specifically asks about it.

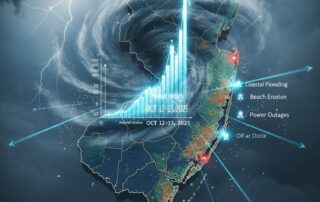

Navigating the Waters: NJ Flood Disclosure Law in the Nor’easter’s Wake

The recent Nor'easter brought New Jersey's new flood disclosure laws into sharp focus for homeowners and landlords.

New Jersey Estate and Inheritance Tax Planning: 2025 Update for High-Net-Worth Families

Learn the key differences between the New Jersey estate and inheritance tax in 2025—and why now is the time to plan before federal exemptions expire.

The Big Tax – Brewed In Monmouth: The Real Estate Tea Podcast Drop!

A new law has unexpectedly shifted New Jersey's "mansion tax" from the buyer to the seller, placing a significant new burden on homeowners.

NJ Mansion Tax Changes 2025: What Sellers Need to Know

New legislation has brought significant changes to New Jersey's "mansion tax," primarily impacting sellers of high-value residential properties. Understanding these updates is crucial for a smooth real estate transaction.

Ready for the 2026 Federal Estate Tax Exemption Sunset?

The federal estate tax exemption sunset is set for 2026. Learn how this change impacts your estate plan and why New Jersey residents should act now.

Building Dreams: Navigating New Jersey Land Use and Zoning with Confidence

Thinking about a new development in NJ? Don't get caught in the complex web of land use and zoning laws! Attorney Andrew Krantz from Zager Fuchs is here to guide you through permits, variances, and approvals.